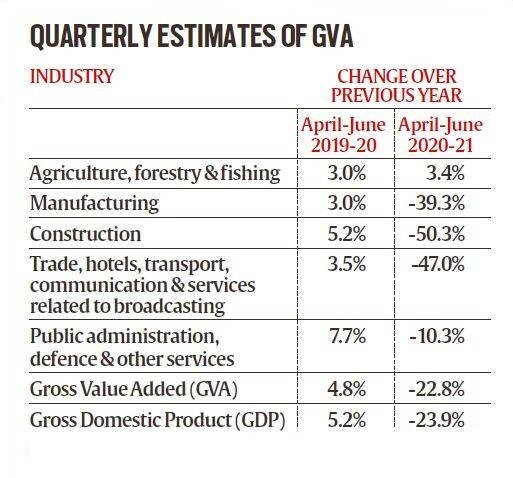

GDP growth rate contracted by 23.9% for the April to June quarter.

Construction, manufacturing, trade, hotels and other services and mining were the worst-hit sectors, recording contractions of 50.3%, 39.3%, 47.0% and 23% respectively. This reflects the unprecedented suspension of economic activity in the first quarter of this fiscal due to the pandemic and the series of lockdowns. Only the agriculture sector showed a positive growth at 3.4%.

According to data released by the National Statistical Office, India’s GDP growth rate contracted by 23.9% for the April to June quarter.

The contraction reflects the severe impact of the COVID-19 lockdown, which halted most economic activities, as well as the slowdown trend of the economy even pre-COVID-19. Economists expect this to contribute to a contraction in annual GDP this year, which may be the worst in the history of independent India. The Indian economy is in a deeply vicious cycle, where demand is contracting so heavily, while the capacity to neutralise this contraction has also contracted equally because of the tax revenue contraction. Last contraction of the economy occurred in 1979-80, when GDP shrank 5.2%. There have been four other instances of minor contraction between 1965-68, and 1972-73.

India is among the worst in countries severely impacted by the Covid-19 pandemic, an analysis of GDP number across major economies has shown.

While China, which many believe to be the epi centre of the Covid-19 outbreak, announced a surprise 3.2 per cent growth in its GDP during this quarter compared to the same period last year, others like the UK and Germany witnessed a contraction. For the April-June period, the UK took a 20.4 per cent hit in its GDP, while Germany experienced a “record” 10.1 per cent contraction

Factors of GDP Contraction:

In any economy, the GDP growth is generated from one of the four engines of growth. i.e. private consumption, demand generated by private sector businesses, demand generated by government and exports.

Private consumption has fallen by 27%. It is the biggest engine that drives the Indian economy.

Investment by private sector businesses have fallen by 47%. It is the second biggest engine.

The net export demand has turned positive in this first quarter because India’s imports have crashed more than its exports.

While on paper, this provides a boost to overall GDP, it also points to an economy where economic activity has plummeted.

The government’s expenditure went up by 16% but this was nowhere near enough to compensate for the loss of demand in other sectors (engines) of the economy.

Implications: On Jobs: The sectors which have contracted (e.g. construction, manufacturing etc.) are the sectors that create the maximum new jobs in the country. Therefore, in a scenario where each of these sectors are contracting, would lead to more and more people either losing jobs (decline in employment) or failing to get one (rise in unemployment). On Informal Sector: The real extent of the economic crisis is expected to be deeper given that the small-scale sector and informal sector is more affected than the organised sector, but is not reflected in the quarterly GDP numbers. In the informal sector, factory output figures are used to extrapolate the trends in the growth. On Banks: The looming defaults in the banking sector after the moratorium ends will add to the banking sector woes, impacting bank’s lending. Also, there are worries regarding household debt, with incomes stagnating, salary cuts and job losses. On Economy: With GDP contracting by more than what most observers expected, it is now believed that the full-year GDP could also worsen. A fairly conservative estimate would be a contraction of 7% for the full financial year. Possible Solution As the incomes of individuals fall sharply, they reduce consumption. When consumption falls sharply, businesses stop investing. Since both of these are voluntary decisions, there is no way to force people to spend more and/or coerce businesses to invest more

The same logic holds for exports and imports as well. Therefore under these circumstances, there is only one engine that can boost GDP, that is the government. Only when the government spends more — either by building roads and bridges and paying salaries or by directly handing out money — can the economy revive in the short to medium term. If the government does not spend adequately enough then the economy will take a long time to recover. The Indian Government can also adopt the measures suggested by McKinsey Global Institute in which an additional 3.5 % of the GDP can be raised by the government.

Global trends such as digitization and automation, shifting supply chains, urbanization, rising incomes and demographic shifts, and a greater focus on sustainability, health, and safety can become the hallmarks of the post-pandemic economy. Higher Productivity through Privatisation: Privatisation of 30 or so of the largest state-owned enterprises to potentially double their productivity. The government also had a focus on privatisation under the Atmanirbhar Bharat Package. Improvement in Infrastructure: India needs to unlock supply inland markets to reduce land costs by 20-25%, enable efficient power distribution to reduce commercial and industrial tariffs by 20-25%; and improve the ease and reduce the cost of doing business. Efficient Financing: Streamlining fiscal resources can deliver USD 2.4 trillion in investment while boosting entrepreneurship by lowering the cost of capital for enterprises by about 3.5 percentage points. Bad Bank: Creation of a ‘bad bank’ can take care of the inoperative assets.

What's Your Reaction?